Gen Z FICO scores higher than Millennials & Gen X

Gen Z may be just getting into their credit-using years, but they are already showing significant differences in their credit profiles from the Millennials and GenXers that preceded them – and outhe latest Data Lab survey reveals a surprising insight into the economy’s youngest generation.

Data Lab recently analyzed just over 5 million NearPrime loan applications received between July 2018 and July 2019 to find that Gen Z, or those born after 1996, have an average FICO score that’s higher than both Millennials and Gen X. [1] This is especially interesting when you consider that how long you’ve had credit is a key factor when it comes to credit scoring. And even with duration of credit use playing a role in FICO scores, Gen Z is off to a strong start in building their credit profile.

Making up 40% of consumers by 2020, this rising post-Millennial generation thinks about personal finance differently than any other age group, setting the stage for lasting change across the financial landscape.

Gen Z uses personal loans differently than all other generations.

After analyzing the applications of nearly 87,000 Gen Zers across the country, LendingPoint found that this generation is looking to personal loans for more than just debt consolidation.

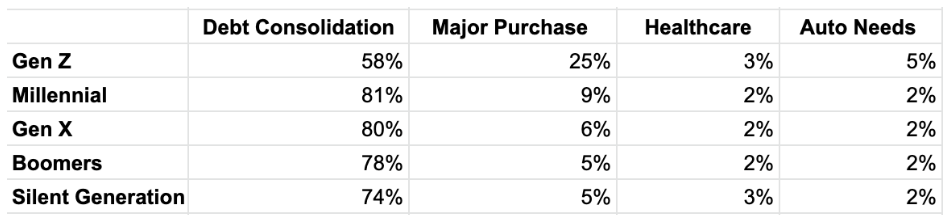

In fact, only 58% of Gen Zers living in metro regions have applied for loan consolidation, while more than 74% of all other generations – including Millennials – use personal loans for consolidation purposes. And while many Gen Zers may be too young to consolidate, it’s interesting to note how they plan to use the personal loans they apply for.

What does Gen Z want personal loans for?

- 3X more likely than a Millennial to apply for loans for a major purchase.

- 2X more likely than both Gen X and Millennials to apply for loans for healthcare.

- More than 2X more likely than a Millennial to apply for loans for auto needs.

What accounts for this shift in credit score and use of funds? Formative years play a role. While credit cards aren’t as prominent as they once were among Millennials, Gen Zers are comfortable using credit cards, loans, and other forms of debt to finance their wants and needs.

- TransUnion found the number of credit-eligible Gen Zers carrying a credit card balance increased 41% year-over-year, while the number of Gen Xers and Millennials carrying a credit card increased by only 5%.

- The report also found that a growing portion of Gen Z took on some kind of debt during the first half of 2019.

- At the same time, Gen Z is more likely to secure personal loans from Fintech firms rather than more traditional lenders.

However, Gen Z has learned from the past, and collectively take a more practical approach to personal finance. As children, their formative years were dominated by the Great Recession and they watched as their parents dealt with financial uncertainty and job insecurity. As a result, they don’t borrow less, just differently.

- 89% of Gen Zers say planning for their financial future makes them feel empowered, while 64% have already begun researching financial planning.

- Gen Z is borrowing in lesser amounts, in fact, LendingPoint’s data finds that Gen Z has a lower average loan amount at $8,462, than all other generations who request between $11,000 – $11,500 on average.

- Gen Z thinks through their purchases more, with 72% saying cost is the most important factor when making a purchase.

It seems Gen Z doesn’t want to find themselves in the position their parents were put in during the Great Recession, and they prioritize financial stability and consider purchasing decisions. This financially conservative mindset may be the driver behind Gen Zers’ higher credit scores than both Gen X and Millennials, despite their growing interest in debt.

Comments

Post a Comment